Have you seen the Nigerian Insurance Market 2023 report by Techpoint Africa yet?

Africa’s population is 15% of the world’s total population. Interestingly, its Insurance market contributes less than 1% to the global Insurance market, showing a huge disparity between the potentials of Insurance and its realization on the continent.

While reviewing the campaigns we worked on last year, I couldn’t take my mind off Search Engine Optimization we did for a leading digital Insurance infrastructure provider for Insurance and non-Insurance businesses across Africa.

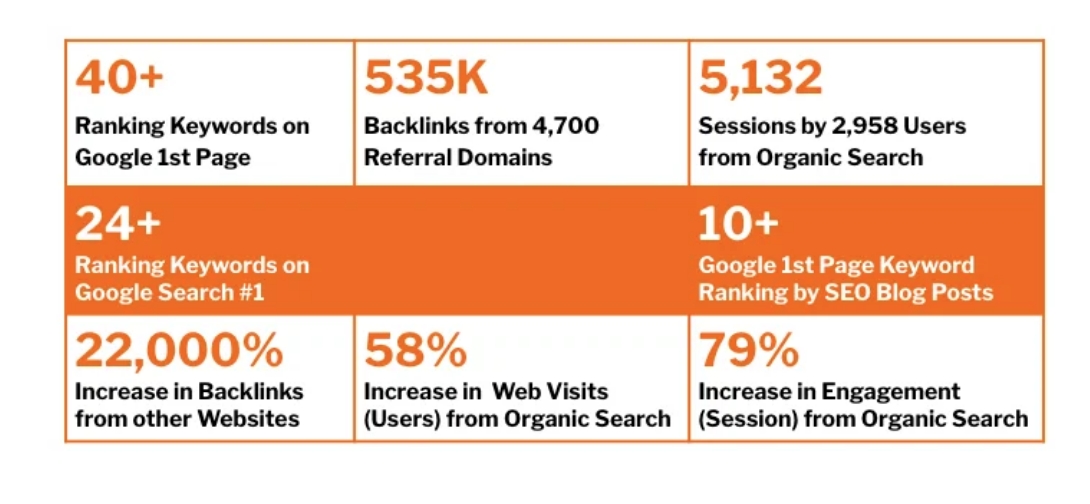

Why? We ranked the client’s website for 40+ Google Search first page keywords relating to digital Insurance solutions, services and challenges in Africa, which has led to 58% increase in web visits, 83% more site engagement and reduced bounce rate by 16%.

In plain English, if you Google anything Digital Insurance in Nigeria or Embedded Insurance Infrastructure in Africa, our client’s website will rank on the first page.

One of the key learnings I took while engaging with the client’s team is the huge gap between the potentials of the Insurance sub-sector versus the current level of adoption, not only in Nigeria but also in Africa and emerging markets.

To buttress what I learnt, I found the Nigerian Insurance Industry 2023 report by Techpoint’s Intelpoint. I didn’t find the incredible low penetration of Insurance in Nigeria as highlighted by the report surprising anymore.

But, the impact of the notorious 2020 COVID-19 pandemic on Nigerian businesses accompanied by looting and vandalism perpetrated by hoodlums who took advantage of the EndSARS protests dazzled me.

Now, the elephant-sized meat on my gist…

388 business owners who suffered losses during the events of the October 2020 crisis were interviewed by Intelpoint, only 3.6% of them had an insurance cover for their businesses. What do you think is the fate of the remaining 96%?

Most of them permanently shut down, a few of them were able to savage their ventures with favours from family and friends while some took loans with ridiculously high interest rates that are still hurting the business till date.

It felt like the wall of China fell off my eyelids at this point. Then, I asked myself…

If running a business in Nigeria (or anywhere else) means taking a big risk, how would you describe the size of risk taken by Nigerian businesses who do not have Insurance covers for their people, products and properties?

It is an insane risk to run a business in Nigeria without proper Insurance covers. That was my conclusion as this realization hit close to home. If you know, you know…

Actionable Insights from Nigerian Insurance Market 2023 Report

Now, let me share my personal key points from the Nigerian Insurance Industry 2023 report by Techpoint with you:

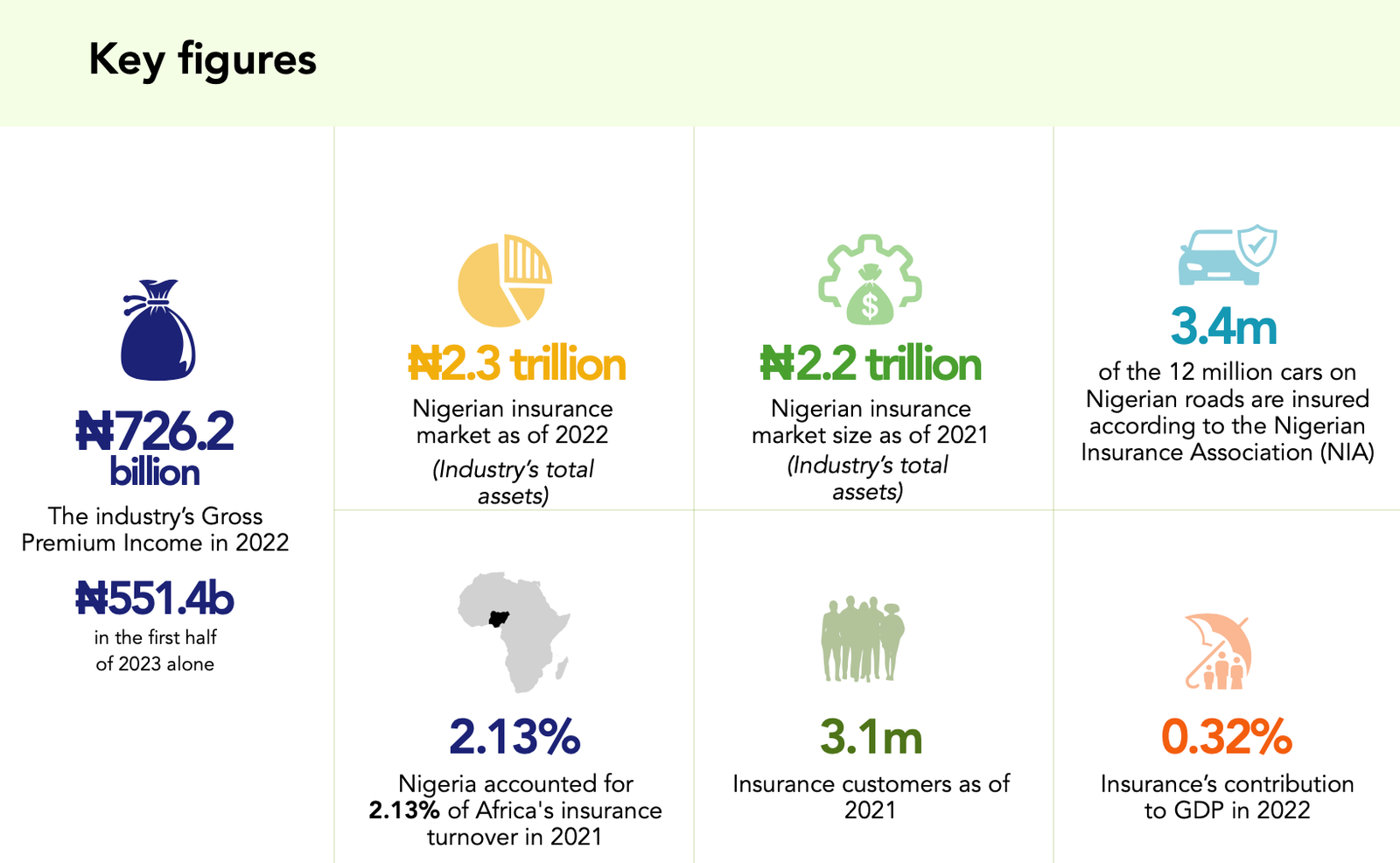

- Nigeria has the largest population in Africa (over 200 million) and 8 compulsory Insurance covers which include Vehicle and Health. Yet, Nigeria’s Insurance market penetration ranked 5th in 2021 on the continent after South Africa (62 million), Morocco (37 million), Egypt (102 million), and Kenya (54 million), in that order.

- Per the Nigerian Insurance Industry Database (NIID), only 3.4 million out of 12 million registered vehicles in Nigeria as of January 2022 had at least a third-party insurance cover. That’s a paltry 28%.

- 388 business owners who suffered losses during the events of October 2020 were interviewed, only 3.6% of them have insurance cover for their businesses. 52% of business owners who had Insurance cover had at least a bachelor’s degree, alluding to the fact that literacy level of business owners in Nigeria impacts insurance adoption.

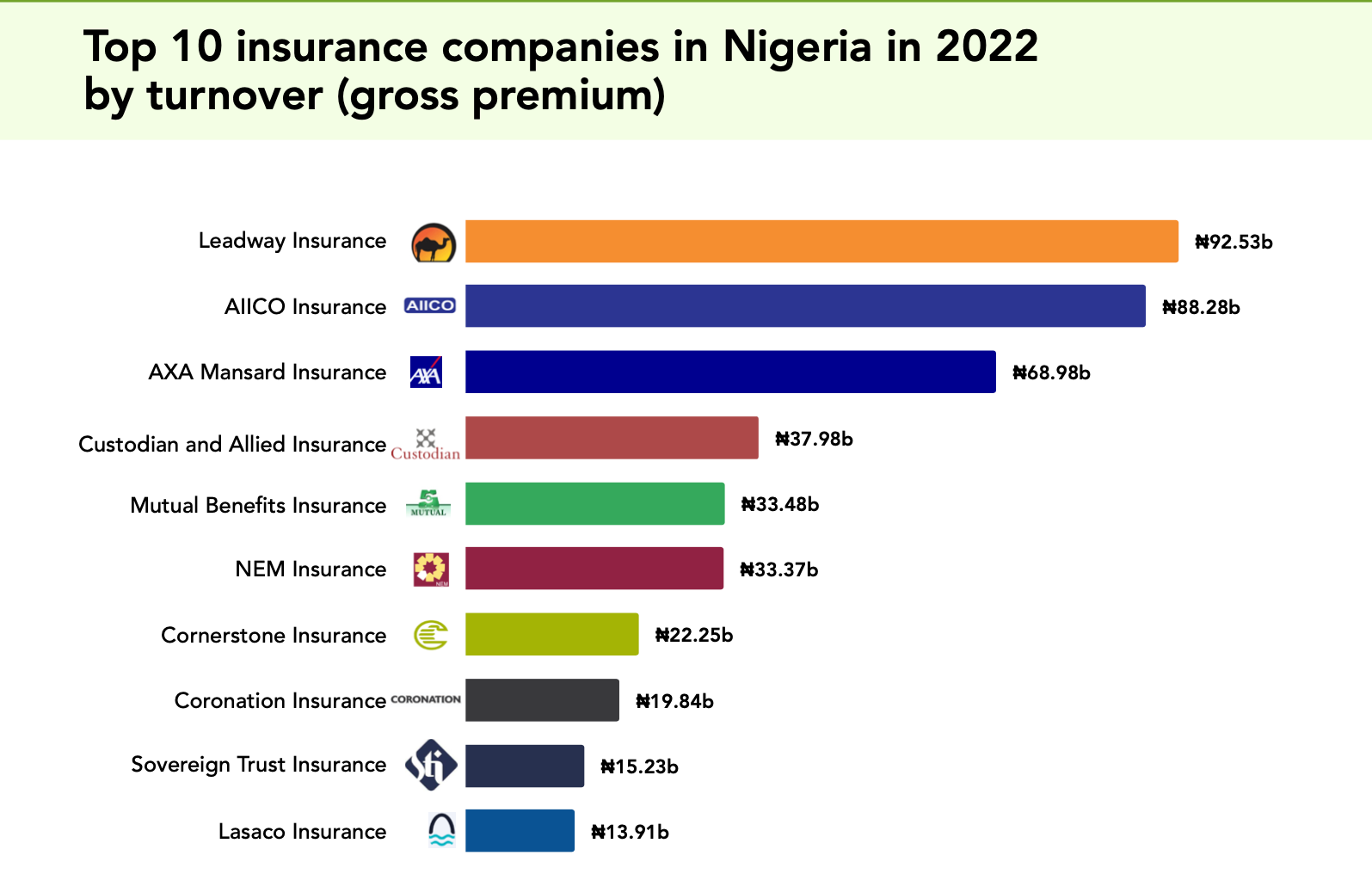

- Leadway Insurance (N92.53 billion), AIICO Insurance (N88.28 billion), AXA Mansard (N68.98 billion), Custodian and Allied Insurance (N37.98 billion), and Mutual Benefits Assurance (N33.48 billion) were the top 5 insurance companies in Nigeria in 2022 based on gross premium turnover.

- Per EFInA’s Access to Financial Services in Nigeria 2020 survey, 2.1 million Nigerian adults had Insurance cover, 7 out of 10 insured adults were male, and 88% of insured adults had a secondary education.

Factors Influencing Insurance Penetration in Nigeria

- Education: people don’t know enough about the benefits, process and dangers of not insuring their lives, properties and businesses.

- Age: there are more older business owners with Insurance covers than younger ones in Nigeria. This shows that the longer people run businesses, the more conscious they become of risks of not having Insurance covers.

- Community: Nigerians without insurance covers for their businesses mostly fall back on their friends and family, while others use periodic contributions (ajo, esusu, etc) and cooperative societies, among others.

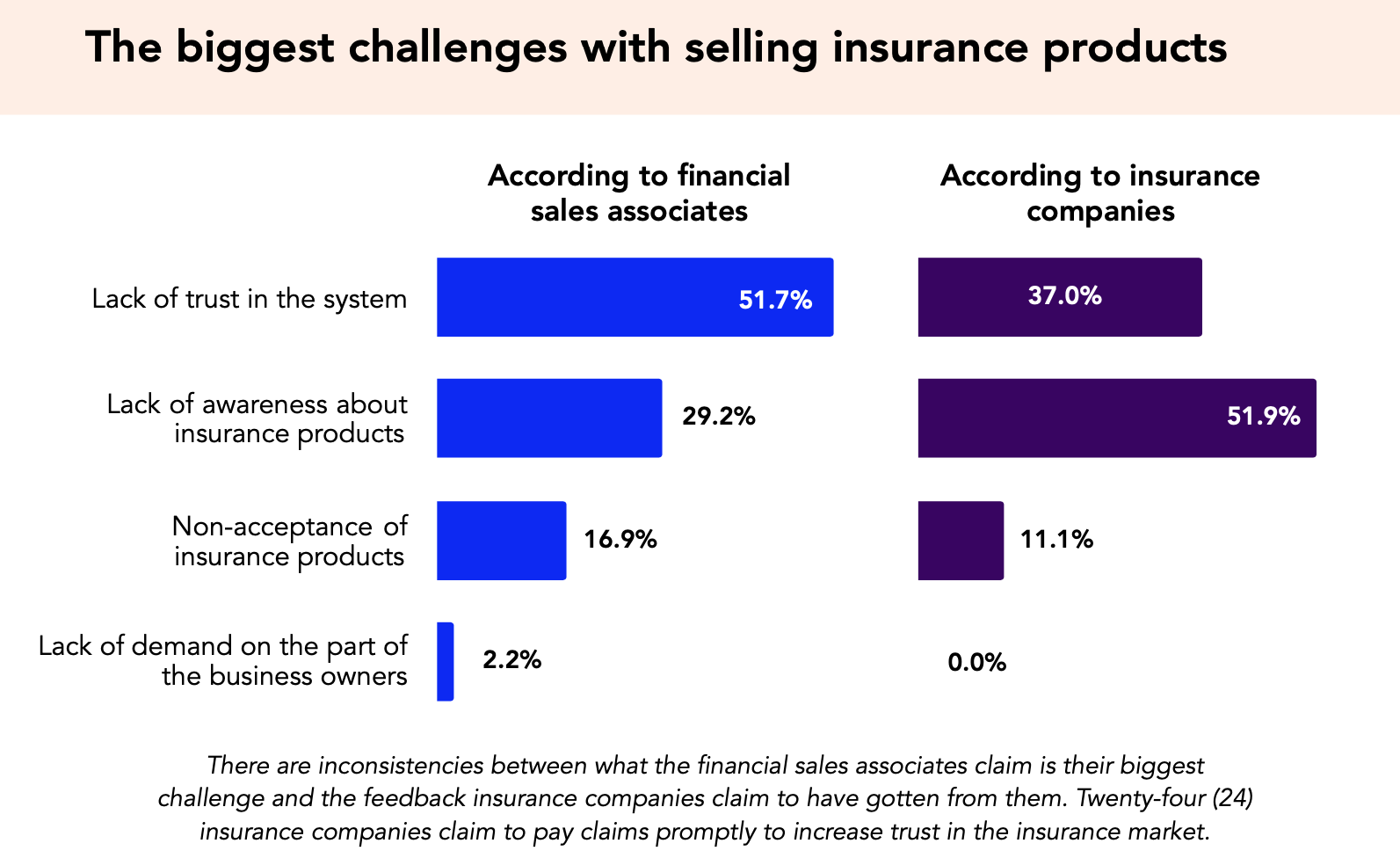

- Trust: inability to meet monthly sales targets is one of the Nigerians Insurance sales agents’ major pain points. They attribute this problem to lack of trust in the Insurance system by the majority of the prospects they engage.

Above all my brethren, I have two takeaways for you – check with your Admin, Operations and Finance teams if your business is adequately insured. May we not be deliberately unfortunate. Amen.

Secondly and lastly, if you are an Insurance company or sell Insurance products online in Nigeria but you are NOT working with us in 2024, you done gree for low brand visibility be that! Lol.